Tally.ERP9 Solutions

Nidhi Solutions

Tally ERP 9 as a product is primarily used for accounting, inventory and statutory compliances and is capable of meeting your business needs, as is However due to the unique nature of the processes and contexts, each business has its own specific needs This can be effectively addressed by solutions built on Tally ERP 9

Our custom built solution contain wide ranging features to handle all aspects of Nidhi Companies.

We’ve customized Tally ERP 9 to meet the specific requirements of Nidhi Companies, so that it can really fit into your needs

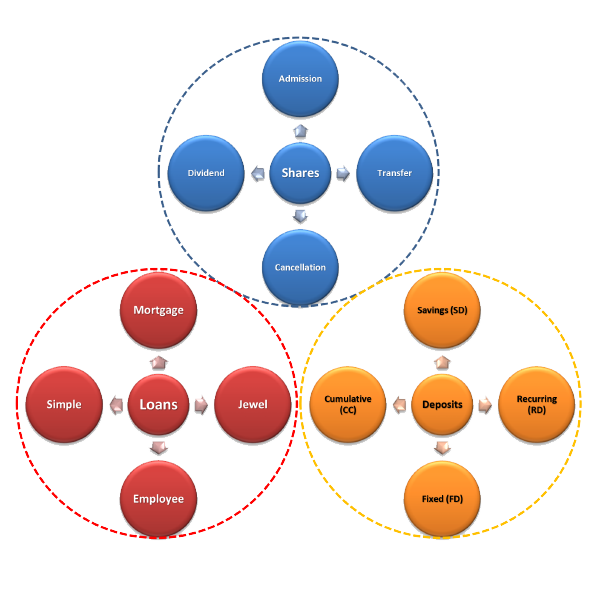

Deposits

One of the major activity for any Nidhi company is to collect and manage the deposits from its members.

Our solution caters to the needs of following types of Deposits:

Saving Deposit (SD)

Recurring Deposit (RD)

Fixed Deposit (FD)

Cumulative Deposit / Cash Certificate (CC)

Solution Features:

Account Opening

Installment Collections (RD)

Accept Deposits Cash / Cheque / Adjustments

Maturity Payments (FD & CC)

Pre Closure Payments

Interest Payments

Account interest on accrual basis

Settlement process

Account renewal

Maturity notice

In operative account handling

Reports:

List of deposit accounts as on date and on previous months (SD,RD)

Ledger printing for selected / all accounts for selected Period (SD,RD)

List of standing instructions affecting the accounts (SD,RD)

Interest paid and accrued on the Deposit Account wise / All the accounts for selected period selected

Printing of Certificates / Interest warrants (FD,CC)

Maturity list of deposit accounts for the selected period

List of accounts matured as on date

Account wise defaulters details with ageing options (RD)

Notice of Maturity (FD, CC)

Address label printing for group customers

Loans:

Other major activity in any Nidhi company is to issue and manage the loans to its members.

Our solution caters to the needs of following types of Loans:

Mortgage Loan (Registered, Unregistered)

Jewel Loan

Simple Loan (Against RD, FD, CC)

Employee Loan

Solution Features:

Loan Sanction and disbursal

Dues Collection (Principal, Interest, Penal Interest, Liquidated damages & reimbursable expenses)

Loan Closure

Loan Pre Closure

Loan renewal

Reports:

Interest Calculation sheet for selected account for selected period

Account wise outstanding report

Interest paid and accrued on the Loan Account wise / All the accounts for selected period

Address Label for Loan Account Group Customers

Loan Account wise Defaulter details with ageing options

Loan till date with Security (for Simple and Employee Loans)

Loan till date with value and weight (Jewel loan)

Account wise over due of installments (Jewel loan)

Due dates for each account (Jewel loan)

List of Loan account due for settlement, Date Wise and Period Wise (Jewel Loan)

Penalty Interest on overdue Installment (Jewel loan)

Booking of interest on Overdue installment (Jewel loan)

Shares (Membership)

Share ( Management form another major activity in any Nidhi company

Our solution caters the following features for managing these activities

Allot Shares Cash Cheque Receipt

Share Member Registry

Share Transfer

Dividend Payment and account

Share Cancellation Forfeiture

Loan till date with Security (for Simple and Employee Loans)

Loan till date with value and weight (Jewel loan)

Account wise over due of installments (Jewel loan)

Due dates for each account (Jewel loan)

List of Loan account due for settlement, Date Wise and Period Wise (Jewel Loan)

Penalty Interest on overdue Installment (Jewel loan)

Booking of interest on Overdue installment (Jewel loan)

Other Features

Apart from the above major functionalities, our solutions provides the following general features for handling the operations efficiently in any Nidhi company

Create Rate master for Deposits/ Loans Scheme wise with effective date and option to close a scheme

Receipts Deposit Receipts, Receipt Acknowledgement, Printing and recovery

Payments Payments in Cash/Cheque/Adjustments against deposit maturity/dividend

Linking of folio/ member with Deposits and loans

Day end operation to apply standing instructions, crediting interest dues

Month end operation for interest on accrual basis adjustment of due account, identification of inoperative account

Projected interest for a financial year for a member

Rounding off of interest calculation

Reports

Daily Reports For Deposit Collection Payments